- TYPES OF INFLATION

UNIT 3 – INFLATION – PART 3

Types of Inflation

Depending on the magnitude and pace of price rise inflation can be classified into several categories:

- Creeping Inflation

Creeping or mild inflation is when prices rise 3 percent a year or less. It erodes the purchasing power of money but manageable and inevitable in a growing economy.

- Trotting or walking Inflation

This type of strong, or pernicious, inflation is between 3-10 percent a year. It is harmful to the economy because it heats up economic growth too fast. People start to buy more than they need, just to avoid tomorrow’s much higher prices. This drives demand even further so that suppliers and wages can’t keep up with this. As a result, common goods and services are priced out of the reach of most people.

- Galloping Inflation

When inflation rises to 10 percent or more, it creates an absolute havoc on the economy. Money loses value so fast that business and employee income can’t keep up with costs and prices. Foreign investors avoid the country, depriving it of needed capital. The economy becomes unstable, and government lose its credibility. Galloping inflation must be prevented at all costs.

- Hyper Inflation

Hyperinflation is when prices skyrocket more than 50 percent a month. It is very rare. Examples of hyperinflation are Germany after World War I.

To summaries:

TYPE OF INFLATION | RATE OF INCREASE |

1. Creeping inflation

| 1-4% When the rate of inflation slowly increases over time. For example, the inflation rate rises from 2% to 3%, to 4% a year.

|

2.Walking inflation | 2-10% When inflation is in single digits – less than 10%. At this rate – inflation is not a major problem, but when it rises over 4%, Central Banks will be increasingly concerned. Walking inflation may simply be referred to as moderate inflation |

3.Running inflation | 10-20% When inflation starts to rise at a significant rate. It is usually defined as a rate between 10% and 20% a year. At this rate, inflation is imposing significant costs on the economy and could easily start to creep higher.

|

4. Galloping inflation | 20%-1000% This is an inflation rate of between 20% up to 1000%. At this rapid rate of price increases, inflation is a serious problem and will be challenging to bring under control. Some definitions of galloping inflation may be between 20% and 100%. |

5. Hyperinflation |

> 1000% This is reserved for extreme forms of inflation – usually over 1,000% though there is no specific definition. Hyperinflation usually involves prices changing so fast, that it becomes a daily occurrence, and under hyperinflation, the value of money will rapidly decline.

|

- Structural Inflation

Also known as Bottleneck Inflation. This happens due to unchecked government policies. Such Inflation occurs from time to time because of weather and seasonal conditions. Inflation in India is largely due to structural factors.

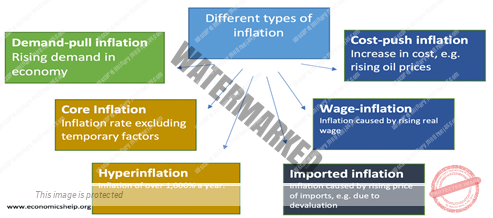

- Core inflation

One measure of inflation is known as ‘core inflation’. This is the inflation rate that excludes temporary ‘volatile’ factors, such as energy and food prices. This concept is majorly used in the western countries. But for countries like India where food and energy constitute major proportion of the basket this concept is not fully effective in showing the price rise. Since 2015 India also follows core inflation also as a measure.

- Disinflation

It implies reduction in the Inflation rate over time (where Inflation is in declining trajectory but remain positive.)

- Deflation

Deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0%.

- Reflation

It is an attempt to bring back inflation into an economy to induce growth. It is deliberately brought by the government to reduce unemployment and increase demand. Government spends higher public expenditures tax cuts, interest rate cuts etc.

- Stag flation

Situation in an economy when Inflation and unemployment both are at high level. (ie) combination of high Inflation and low growth. This situation occurs when the Inflation may have gone out for long time.

Recession

It is a situation which is characterized by negative growth rate of GDP in two successive quarters. Some indicators of recession are

- Slowdown in the economy

- Fall in investment

- Fall in output of the economy etc.

Depression is an extreme form of recession

- Skewflation

Economists usually distinguish between inflation and a relative price increase. ‘Inflation’ refers to a sustained, across-the-board price increase, whereas ‘a relative price increase’ is a reference to an episodic price rise pertaining to one or a small group of commodities. This leaves a third phenomenon, namely one in which there is a price rise of one or a small group of commodities over a sustained period of time, without a traditional designation. ‘Skewflation’ is a relatively new term to describe this third category of price rise.

In India, food prices rose steadily during the last months of 2009 and the early months of 2010, even though the prices of non-food items continued to be relatively stable. As this somewhat unusual phenomenon stubbornly persisted, and policymakers conferred on how to bring it to an end, the term ‘Skewflation’ made an appearance in internal documents of the Government of India, and then appeared in print in the Economic Survey 2009-10, Government of India, Ministry of Finance.

The skewedness of inflation in India in the early months of 2010 was obvious from the fact that food price inflation crossed the 20% mark in multiple months, whereas wholesale price index (WPI) inflation never once crossed 11%. It may be pointed out that the Skewflation has gradually given way to a lower grade generalized inflation, with the economy in the middle of 2011 inflating at around 9% with food and non-food price increases roughly at the same level.