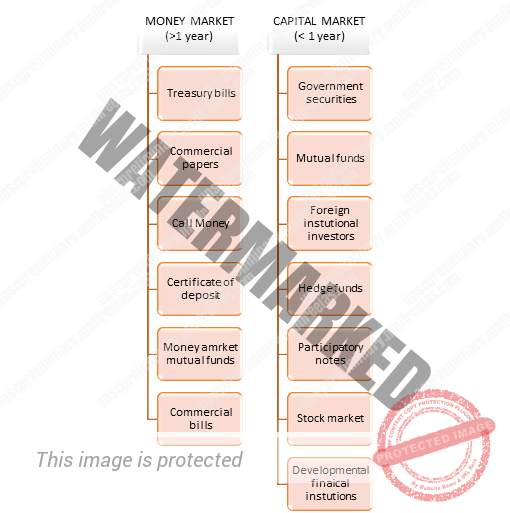

- FINANCIAL MARKETS

- MONEY MARKET (SHORT TERM MARKET)

- CAPITAL MARKET (LONG TERM MARKET)

UNIT 4 – MONEY & BANKING – PART 22

FINANCIAL MARKETS

INTRODUCTION

In an economy, money or financial resources like Credit, Mutual Funds, Securities etc. play the most important role in transactions. In order to mobilize funds, keep it circulating in the economy a system such a market is required. Hence financial market refers to borrowing and lending of funds for business and investment.

The market of an economy where funds are transacted between the fund surplus and fund deficit is known as financial market. It can be organized and unorganized. The major 2 segments of the financial market are short term market and long-term market.

MONEY MARKET (SHORT TERM MARKET)

Money market refers to a section of Financial Market where financial instrument with high liquidity and short-term maturities are traded. It provides short term debt financing and investment for solving liquidity crisis. Money Market allows firms to borrow funds on a short term basic.

It is basically the funds available for a year, within the year. Here the short terms funds are bid by the borrowers without collateral or pledging for security. The funds are borrowed on a discount rate.

Moneylenders, unregulated non-banking financial intermediaries like Chit Funds and Nidhi Companies, Indigenous Bankers Like Marwari etc. form part of the unorganized money market.

The organized money market has specific instruments like call money, commercial paper etc. (it will be discussed in the coming section).

Money market is useful for large Institution and Govt. to manage their short-term cash needs.

Note: In money market,

- Savings in Bank Account is not said to be financial instrument.

- But Fixed Deposit is usually as a financial Instrument to be used for lending purposes as a loan.

iii. Participant in money market consists of Financial Institutions and dealers in money (or) credit who wish to either borrow or lend for short period up to 1 year.

- Core of money market consists of Interbank lending – banks borrowing and lending to each other using instruments like commercial paper, Repo, etc.

- These instruments are priced at the rate of LIBOR for appropriate term and currency.

- In Indian money market, RBI plays the central role; It regulates and controls the money market.

CAPITAL MARKET (LONG TERM MARKET)

Here the funds are available for a period of more than a year. It is a big market which is mainly used for mobilizing capital for big investments and projects. After the banking industry, it is the next big industry for creation of assets in the economy. It is the stock market which is the lifeline of running business activities and corporates. The demand for long term funds for investment mainly comes from industries and government. Institutional framework is required to run the Capital market. SEBI controls the capital market.

Capital markets are venues where savings and investments are channeled between the suppliers who have capital and those who are in need of capital. Capital market is of two types (i.e.) primary market and Secondary Market.

In Primary market new shares are issued and sold. In secondary market, where already – issued securities are traded between Investors. The most common capital markets are the stock market and the bond market. It is the place were buying and selling of securities takes place.