- DIGITAL PAYMENT SYSTEMS

- IMMEDIATE PAYMENT SERVICES

- IMPS, NPCI, AEPS, BHIM, BHARAT BILL, UPI

- TYPES OF ATM

- CRYPTO – CURRENCY AND BLOCK CHAIN TECHNOLOGY

UNIT 1 – NATURE OF INDIAN ECONOMICS – PART 4

DIGITAL PAYMENT SYSTEMS:

National Electronic Fund Transfer (NEFT)

The initial electronic fund transfer system introduced in the late 1990s enabled an account holder of a bank to electronically transfer funds to another account holder with any other participating bank. Later in 2005, RBI has launched National Electronic Fund Transfer (NEFT) Scheme with advanced and secure features for facilitating one-to-one funds transfer requirements of individuals / corporate.

Individuals, firms or corporate maintaining accounts with a bank branch can receive funds through the NEFT system. It is, therefore, necessary for the beneficiary to have an account with the NEFT enabled destination bank branch in the country.

There is no limit – either minimum or maximum – on the amount of funds that could be transferred using NEFT. However, maximum amount per transaction is limited to Rs.50, 000/- for cash-based remittances within India.

REAL TIME GROSS SETTLEMENT (RTGS)

RTGS provides continuous (real-time) settlement of funds transfers individually on an order by order basis (without netting). Here, ‘Real Time’ means the processing of instructions at the time they are received rather than at some later time. Similarly, ‘Gross Settlement’ means that settlement of funds transfer instructions occurs individually (on an instruction by instruction basis)

Difference Between NEFT And RTGS

Under RTGS the transactions are settled individually. RTGS transactions are processed continuously throughout the RTGS business hours.

The NEFT platform is primarily aimed for small value transactions. At one transaction the maximum value should be Rs 50000.

On the other hand, the RTGS is aimed for large value transactions. The minimum amount to be remitted through RTGS is Rs 2 lakh. There is no upper ceiling for RTGS transactions.

IMMEDIATE PAYMENT SERVICES

Immediate Mobile Payment Services (IMPS) is a real time instant inter-bank funds transfer system managed by National Payment Corporation of India (NPCI). IMPS is available 24/7 throughout the year. Minimum Transfer Limit is Rs. 1 and Maximum Transfer Limit is Rs. 2 lakh.

NATIONAL PAYMENT CORPORATION OF INDIA (NPCI)

National Payments Corporation of India (NPCI), an umbrella organisation for operating retail payments and settlement systems in India, is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007, for creating a robust Payment & Settlement Infrastructure in India.

NPCI, during its journey, has made a significant impact on the retail payment systems in the country. RuPay is an indigenously developed Payment System – designed to meet the expectation and needs of the Indian consumer, banks and merchant eco-system. RuPay supports the issuance of debit, credit and prepaid cards by banks in India and thereby supporting the growth of retail electronic payments in India.

NPCI HAS BANK FOLLOWING PLATFORM

AADHAAR ENABLED PAYMENT SYSTEM ( AEPS)

In order to further speed track Financial Inclusion in the country, AePS was introduced. AePS is a bank led model which allows online interoperable financial inclusion transaction at PoS (MicroATM) through the Business correspondent of any bank using the Aadhaar authentication. AePS allows you to do six types of transactions.

Its main objective is to empower a bank customer to use Aadhaar as his/her identity to access his/ her respective Aadhaar enabled bank account and perform basic banking transactions like cash deposit, cash withdrawal, Intrabank or interbank fund transfer, balance enquiry and obtain a mini statement through a Business Correspondent.

BHIM AADHAAR PAY

BHIM Aadhaar Pay is meant for merchants to receive digital payments from customers over the counter through Aadhaar authentication. It allows for any merchant associated with any acquiring bank on BHIM Aadhaar Pay service, to allow the merchant to accept payment from a customer of any bank, by authenticating the customer’s biometrics – currently only fingerprints, directly from the customer’s Aadhaar enabled bank account and receive the sale proceeds instantaneously directly into merchant’s own bank account.

BHARAT BILL PAYMENT SYSTEM

Bharat Bill payment system is an integrated Bill Payment System offering interoperable and accessible bill payment service to customer through a network of agents of registered member as agents’ institutions, enabling multiple payment modes and providing instant confirmation of payment.

UNIFIED PAYMENT INTERFACE

Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood. It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience.

BHARAT QR

A QR code consists of black squares arranged in a square grid on a white background, which can be read by an imaging device such as a camera. It contains information about the item to which it is attached.

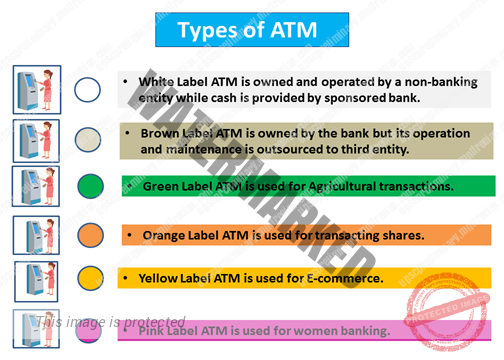

TYPES OF ATM’S:

Bank label

Bank itself runs the networks.

Brown label ATM

When banks outsourced the ATM operation to Third party.

White label ATM

- ATM’s Set up, owned and operated by non- bank entities called white label ATM.

- Cash in ATM is provided by the Sponsored bank

- white ATM does not have any branding of Bank.

CRYPTO – CURRENCY AND BLOCK CHAIN TECHNOLOGY

CRYPTO CURRENCY

A Crypto Currency (Or Crypto Currency) is a digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets. Crypto currencies use decentralized control as opposed to centralized digital currency and central banking systems.

The decentralized control of each crypto currency works through distributed ledger technology, typically a blockchain that serves as a public financial transaction database.

BITCOIN, first released as open-source software in 2009, is generally considered the first decentralized cryptocurrency.

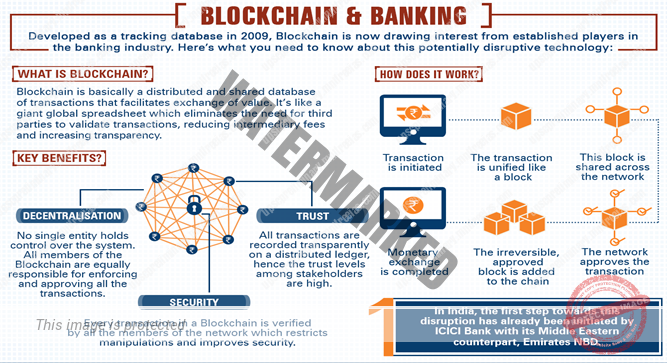

BLOCK CHAIN TECHNOLOGY

A blockchain is a decentralized, distributed, and oftentimes public, digital ledger that is used to record transactions across many computers so that any involved record cannot be altered retroactively, without the alteration of all subsequent blocks. This allows the participants to verify and audit transactions independently and relatively inexpensively.

A blockchain database is managed autonomously using a peer-to-peer network and a distributed timestamping server. They are authenticated by mass collaboration powered by collective self-interests.

- A Secured decentralized data base that Maintains a continuously growing list of rewards / transaction.

- It Mainly used for running Crypto Currency network.