- FISCAL POLICY

UNIT 5 – PUBLIC FINANCE – PART 5

- FISCAL POLICY AND TAXATION

Fiscal policy is the means by which a government adjusts its spending levels and tax rates to monitor and influence a nation’s economy. It is the sister strategy to monetary policy through which a central bank influences a nation’s money supply. These two policies are used in various combinations to direct a country’s economic goals. Using a mix of monetary and fiscal policies, governments can control economic phenomena.

Fiscal policy is the guiding force that helps the government decide how much money it should spend to support the economic activity, and how much revenue it must earn from the system, to keep the wheels of the economy running smoothly.

Fiscal policy is based on the theories of British economist John Maynard Keynes. Also known as Keynesian economics, this theory basically states that governments can influence macroeconomic productivity levels by increasing or decreasing tax levels and public spending. This influence, in turn, curbs inflation (generally considered to be healthy when between 2% and 3%), increases employment, and maintains a healthy value of money.

7.1 Fiscal policy in India

Fiscal policy in India is the guiding force that helps the government decide how much money it should spend to support the economic activity, and how much revenue it must earn from the system, to keep the wheels of the economy running smoothly. In recent times, the importance of fiscal policy has been increasing to achieve economic growth swiftly, both in India and across the world. Attaining rapid economic growth is one of the key goals of fiscal policy formulated by the Government of India. Fiscal policy, along with monetary policy, plays a crucial role in managing a country’s economy.

Through the fiscal policy, the government of a country controls the flow of tax revenues and public expenditure to navigate the economy. If the government receives more revenue than it spends, it runs a surplus, while if it spends more than the tax and non-tax receipts, it runs a deficit. To meet additional expenditures, the government needs to borrow domestically or from overseas. Alternatively, the government may also choose to draw upon its foreign exchange reserves or print additional money.

For example, during an economic downturn, the government may decide to open up its coffers to spend more on building projects, welfare schemes, providing business incentives, etc. The aim is to help make more of productive money available to the people, free up some cash with the people so that they can spend it elsewhere and encourage businesses to make investments. At the same time, the government may also decide to tax businesses and people a little less, thereby earning lesser revenue itself.

7.2 Main objectives of Fiscal Policy in India:

- Economic growth: Fiscal policy helps maintain the economy’s growth rate so that certain economic goals can be achieved.

- Price stability: It controls the price level of the country so that when the inflation is too high, prices can be regulated.

- Full employment: It aims to achieve full employment, or near full employment, as a tool to recover from low economic activity.

What is the difference between fiscal policy and monetary policy?

The government uses both monetary and fiscal policy to meet the county’s economic objectives. The central bank of a country mainly administers monetary policy. In India, the Monetary Policy is under the Reserve Bank of India or RBI. Monetary policy majorly deals with money, currency, and interest rates. On the other hand, under the fiscal policy, the government deals with taxation and spending by the Centre.

7.3 Importance of Fiscal Policy in India:

- In a country like India, fiscal policy plays a key role in elevating the rate of capital formation both in the public and private sectors.

- Through taxation, the fiscal policy helps mobilize considerable amount of resources for financing its numerous projects.

- Fiscal policy also helps in providing stimulus to elevate the savings rate.

- The fiscal policy gives adequate incentives to the private sector to expand its activities.

- Fiscal policy aims to minimise the imbalance in the dispersal of income and wealth.

7.4 Types of fiscal policy

The three main types of fiscal policy are:

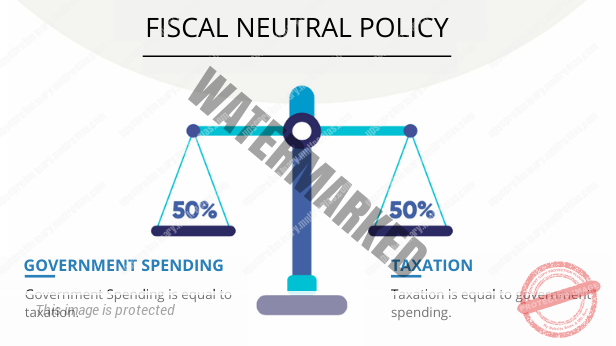

The first type of fiscal policy is a neutral policy, which is also known as a balanced budget. This is where the government brings in enough taxation to pay for its expenditures. In other words, government spending equals taxation.

Under a neutral fiscal policy, governments are restrained on what they spend depending on what they bring in. In a similar fashion, this is what most households do. For instance, the average taxpayer is unable to spend more than they bring in — unless of course, they use credit.

With a neutral fiscal policy, it is difficult to tell how much in tax will be brought in from one year to the next. So, governments often forecast tax receipts year on year and plan accordingly.

- Expansionary Fiscal Policy

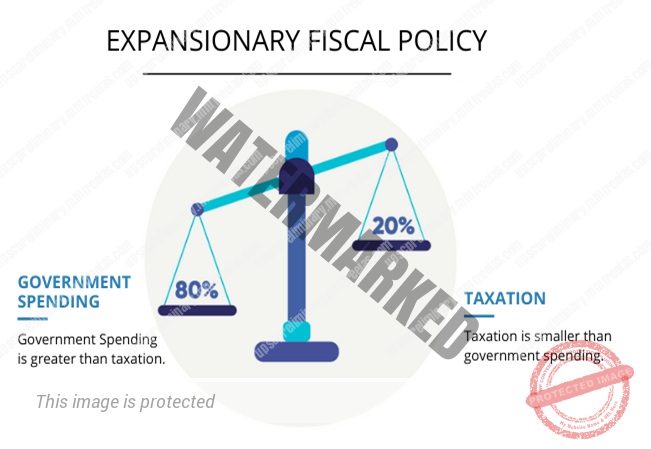

Expansionary fiscal policy is where the government spends more than it takes in through taxes. This may involve a reduction in taxes, an increase in spending, or a mixture of both.

In turn, it creates what is known as a budget or fiscal deficit. During recessionary periods, a budget deficit naturally forms. This is because unemployment tends to increase, meaning lower income from tax receipts which generally account for half of governments revenue.

At the same time, governments want to ensure full employment.

It is therefore faced with a tough decision between increasing the budget deficit further or trying to fight the recession. At the same time, governments are equally forced to pay higher amounts in unemployment and other social security benefits, thereby increasing government spending, whilst tax revenues fall.

Expansionary fiscal policy uses lower taxes and/or higher spending to ultimately boost prosperity and economic growth. By reducing taxes, consumers have more money in their pockets to go out, spend, and stimulate the economy.

At the same time, higher government spending can boost aggregate demand. If it undertakes an investment project, it can create many new jobs. Jobs for people that would otherwise be unemployed. In turn, these employees will have more money to spend, thereby stimulating the economy.

- Contractionary Fiscal Policy

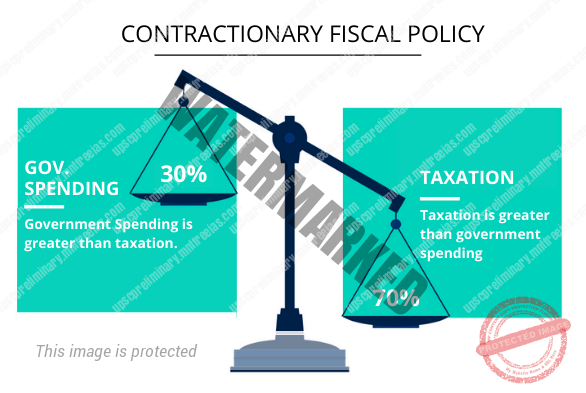

Contractionary fiscal policy is where government collects more in taxes than it spends. A government may wish to do this for several reasons. Primarily, it is used to help stem inflation. For instance, the more governments tax, the less disposable income consumers have. In turn, this reduces aggregate demand which may seem like a bad thing, but it helps reduces inflation.

So, a contractionary fiscal policy will take money away from consumers. Consequently, they demand less from individual businesses. This then sends a signal to those businesses that demand is starting to decline. So they stop raising prices so quickly, thereby reducing the rate of inflation.

With that said, governments may wish to impose a contractionary policy in order to reduce or control their debt. Although we have discussed lower taxation, governments can also resort to lower spending otherwise known as austerity to do so.

We have seen in countries such as Greece, Spain, and Italy a level of spending that was unsustainable. As a result, it had to undertake a contractionary fiscal policy in order to meet its debt payments. What made this so painful was that their economies were going through one of the worse recessions in history.

So, in summary, a contractionary fiscal policy would aim to either reduce inflation or reduce government debt.